candlestick patterns for day trading: 16 Must-Know Candlestick Patterns for a Successful Trade

Contents:

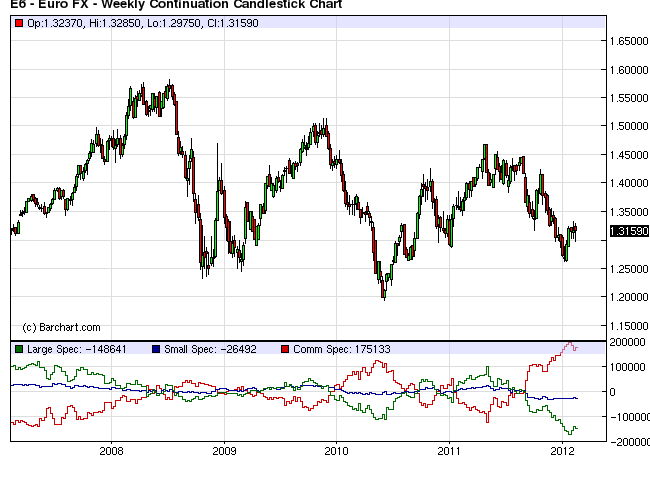

Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Japanese candlestick is the oldest method of technical analysis known to the world. The candlestick chart is one of the most popular charts, allowing traders to quickly and easily interpret price information. For a more in-depth breakdown of different candlestick chart patterns, check out our what are Japanese candlestick patterns guide. The Evening Star pattern is the opposite and signals a bearish reversal is starting.

The long wick above the body suggests there was buying pressure trying to push the price higher, but it was eventually dragged back down before the candle closed. While not as bullish as the regular hammer candle, the inverted hammer is also a bullish reversal pattern that appears after a downtrend. What if after buying, the market reverses its direction and the trade goes wrong? Like I had mentioned earlier, candlestick patterns come with an inbuilt risk management mechanism. In case of a bullish marubozu, the low of the stock acts as a stoploss.

Support

There can be a few discretionary entries on this https://g-markets.net/ depending on experience. Aggressive traders may choose to enter as the candle is forming, if supply is clearly visible. Even though the pattern shows us that the price is falling for three straight days, a new low is not seen, and the bull traders prepare for the next move up. For example, a down candle is often shaded red instead of black, and up candles are often shaded green instead of white. One of the best methods to train your “chart eye” to see these patterns is to simply replay the market, noting each time you see a particular candle. Note the trend is mostly sideways in this first circled example.

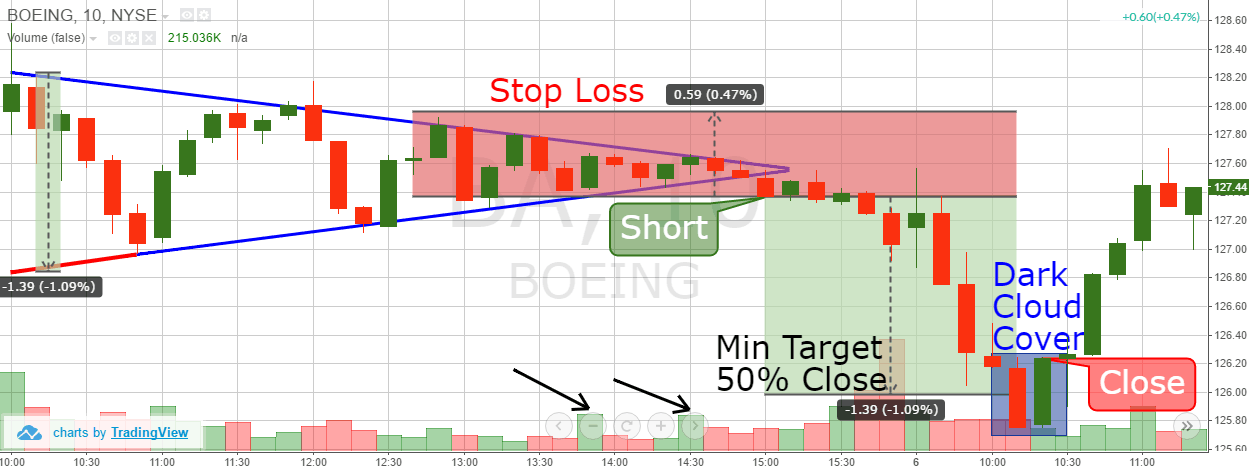

I refer to what I call the “ideal tweezer pattern.” This is a tweezer top or bottom where both candles are of similar size. Now that we have looked at how we adapt regular reversal patterns into intra-day patterns, let’s address the issue of the Tweezer Pattern on an intra-day chart. Another very popular pattern for bearish reversals is the Dark Cloud Cover. This pattern is a highly predictable pattern that typically plays out as a bearish reversal . This content is strictly for informational purposes only and does not constitute as investment advice.

How Long Can You Hold a Short Position?

Second, if you are new to these candlestick patterns, a simple way is to use a candlestick cheat sheet that lists all of them. The black one is bearish candle while the one on the right is the bullish candle. The black and white parts of the candles are known as the body while the two lines are known as shadows.

- Adragonfly dojiis a type of indecision candle that can form at the bottom of a downtrend.

- When trading on short timeframes, the white hammer will be stronger than the black one.

- It is most convenient to overlay the patterns on a candlestick chart, so it is easier to track price fluctuations.

- With this in mind, understanding the emotional story within candlesticks is a great place to start that training.

- Here is another example where both the risk-taker, and the risk-averse trader would have been profitable.

A “small” body can be defined as a body whose width is less than the candle range divided by 3. A bullish pin bar will then have the body located in the upper half of the candle. The thin vertical lines above and below the body are called the wicks or shadows which represent the high and low prices of the trading session.

Technische analyse Candlestick Patterns Chart (Digitaal downloaden)

Bullish engulfing is formed when the body of a white candle completely engulfs the previous black candle, which signals a strong buying impulse. Above, we have discussed Japanese candlestick charts, what they are and how to read them. However, the Heikin-Ashi technique is another way to calculate candlesticks. Heikini-ashi means “average bar” in Japanese, as such, these types of charts rely on average price data.

The Doji pattern can be an effective indicator of breakouts since they often appear during periods of consolidation. One needs to pay some attention to the length of the candle while trading based on candlestick patterns. In general, the longer the candle, the more intense is the buying or selling activity.

You can then select all candlestick patterns and the tool will overlay them on the chart. In the next section, We will explain some of the most popular candlestick patterns. Before that, it is important for you to know how to identify candlestick patterns. This creates the long wicks to look out for similar to the Shooting Star candlestick pattern and trades in the same direction. A bearish engulfing pattern, on the other hand, shows the possibility of the market being taken over by the bears.

Hammer candlestick patterns are one of the most used patterns in technical analysis. Not only in crypto but also in stocks, indices, bonds, and forex trading. Hammer candles can help price action traders spot potential reversals after bullish or bearish trends. Depending on the context and timeframe, these candle patterns may suggest a bullish reversal at the end of a downtrend or a bearish reversal after an uptrend. Combined with other technical indicators, hammer candles may give traders good entry points for long and short positions. The preceding green candle keeps unassuming buyers optimism, as it should be trading near the top of an up trend.

For example, you will see in a moment the 8 bearish candlestick patterns that we describe below. Each one provides a trigger for your entry and allows you to set your maximum risk above the pattern. A bearish engulfing pattern develops in an uptrend when sellers outnumber buyers. This action is reflected by a long red real body engulfing a small green real body. The pattern indicates that sellers are back in control and that the price could continue to decline. The above chart shows the same exchange-traded fund over the same time period.

A bullish engulfing pattern is a significant candlestick as it shows when bulls have flooded the markets and are in control of the session. When you can combine these price points together, they give candlestick patterns that you can take advantage of to predict any market reversals. In this updated guide, we’ll explore the basics of candlestick patterns, including what they are, how to read them, and how to use them to your advantage in forex trading. There are many strong bullish candlestick patterns, and it is hard to determine the most decisive out of them.

Without proper candlestick patterns for day trading underneath, the result can be devastating for long chasers wrongly assuming there is upward momentum. Entry can be made on a close below the reversal candle with a stop set at the high. The tweezer top is yet another reversal pattern or continuation pattern. This gives the attentive trader an opportunity to capitalize by going short. In this intraday example with GME, we notice that the upward trend has been strong.

Candlesticks show that emotion by visually representing the size of price moves with different colors. Traders use the candlesticks to make trading decisions based on regularly occurring patterns that help forecast the short-term direction of the price. The Hanging Man is a candlestick that is most effective after an extended rally in stock prices. The story behind this candle tells us that there were extensive sellers in the formation of the candle, signified by the long wick.

Hammer Candlestick Used in Crypto Technical Analysis Explained – LCX

Hammer Candlestick Used in Crypto Technical Analysis Explained.

Posted: Tue, 22 Nov 2022 08:00:00 GMT [source]

One can learn about Candlesticks and with some effort, one can memorise Candlestick Patterns quickly and apply this knowledge in a short time. There are three types of Doji pattern and they are based on where the open and close line falls on the chart. These are known as the dragonfly, gravestone, and long-legged Doji pattern. Experience a new level of trading with the right support when you need it. Please let me know if there any system to know in an candle formation, what is total buy quantity and what is total sell quantity.

So there we have 8 of the most common bearish candlestick patterns. An engulfing pattern on the bullish side of the market takes place when buyers outpace sellers. This is reflected in the chart by a long green real body engulfing a small red real body. With bulls having established some control, the price could head higher. Bullish patterns indicate that the price is likely to rise, while bearish patterns indicate that the price is likely to fall.

The Doji is considered neutral due to the indecision of the market creating similar opening and closing prices. The open and close of the Doji are nearly identical coupled with a high and low range that is relatively small. As a result, this price action forms in the shape of a plus “+” sign. The Shooting Star will have a long wick emerging from the top of a small body. This means that prices opened in the lower portion of the candle’s range, traded to new highs, then immediately retraced closing near the open.

Watching a candlestick pattern form can be time consuming and irritating. If you recognize a pattern and receive confirmation, then you have a basis for taking a trade. Let the market do its thing, and you will eventually get a high-probability candlestick signal.

So after you initiate a buy trade, if the markets move in the opposite direction, you should exit the stock if price breaches the low of the marubozu. Having some definable rules of entry based on candlestick patterns can really help the aspiring trader. Like a massive tidal wave that completely engulfs an island, the bearish engulfing candlestick completely swallows the range of the preceding green candlestick. The bearish engulfing candlestick body eclipses the body of the prior green candle. Even stronger bearish engulfing candlesticks will have bodies that consume the full preceding candlestick including the upper and lower shadows.

The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Candlestick patterns are used to predict the future direction of price movement. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. For example, in a hammer candlestick, a long shadow means that the reversal is more convincing. At times, you will identify a candlestick with just a body and without shadows. Japanese candlestick patterns are some of the oldest types of charts.

Now while the fourth bar opens even lower than that, it quickly reverses within a wide-range that closes higher than the first bar in the initial Three Line Strike. Essentially, the price falls before reversing past its last high point. Notice in the chart above, a bullish marubozu has been encircled.

Recommended Posts

FocusKPI, Inc hiring Software Engineer in San Francisco, California, United States

1 de setembro de 2022

Fundación Oficial para un Mundo Libre de Drogas, Abuso de Cocaína Crack, Efectos del Crack

14 de julho de 2022

C Sharp programming language Wikipedia

28 de julho de 2021