Content

And finally, you can always provide a general disclaimer that all donations received through a campaign are subject to redirection at the discretion of the organization. The funds cannot be redirected to other purposes, even if the budget law firm bookkeeping picture becomes bleak. It is a difficult situation to be facing unpaid rent and utility bills, or an upcoming payroll, with nothing in the organization’s operating account, but you have $50,000 sitting unused in a Scholarship Fund.

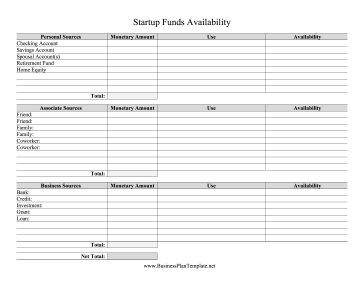

This category of funds is reserved for departmental initiatives, including faculty start-up packages for new hires. Other sources of revenue might include unrestricted grants or contributions and in some cases, it can also be through the release of the temporarily restricted net assets. If you have an audit, you can look at the most recent audited balance sheet.

More Definitions of Unrestricted Net Assets

Policy Statement

The University must properly manage its Unrestricted Net Position (formerly net assets or fund balance) to ensure the financial health of the university and its ability to support its mission and goals in the future. Any planned use of UNP should be documented and expressed within the Narrative accompanying the Annual Budget presented to the Board of Trustees. Using the Andrew Carnegie example, if Carnegie stipulated that the dividends from his donation were to be used for a specific purpose, those dividends would be treated as a temporarily restricted assets as they are received.

Two key ratios are Months of Cash and Months of Liquid https://goodmenproject.com/business-ethics-2/navigating-law-firm-bookkeeping-exploring-industry-specific-insights/ (LUNA). Having months of cash on hand is important, but having unrestricted cash available is essential because it allows an organization to meet its monthly obligations such as rent, payroll and utilities. If you have multiple endowments, grants or restricted large-dollar donations, it is recommended that you track them each in their own fund.

Unobligated Funds

Perhaps the donation is to be used on a specific project or to pay for a specific need the non-profit has. This could be for a specific construction project, the purchase of a vehicle, or for a specific program operating within the non-profit. Through these funds, the organizations can pay off their current expenses as well as look around for other programs or projects that might exist. Now that you know the concept, look at your organization’s balance sheet again with fresh eyes. Keep in mind that, unfortunately, net assets is often not broken out properly in internally generated balance sheets. Even if it is, you may still need to ask questions to understand the nature of any restricted assets.

- You would Debit or Credit Unrestricted and the offset Target is Restricted, Reserves, etc.

- Then, divide total cash by the monthly expense number to get months of cash.

- Unfortunately, unless your organization can generate a lot of earned income, or find donors to fund operating deficits, it may already be too late.

- For example, if you are requesting donations for a specific program, you will then be restricted from using those funds for ancillary or support expenses.

- Science competitions remain a vibrant and important segment of our work and account for 53 percent of all program spending.

Donors can also designate that a gift be used for a purpose they choose, completely independent of any fundraising campaign. Unrestricted funds often make up the majority of donations for small nonprofits. So you can use this money for any organizational need that aligns with your legally declared mission.

II. Financial Management Goals

The important thing to understand is that if you use a disclaimer or caveat, it needs to be very clear to the donor prior to the gift. In keeping with nonprofit standards and best practices, the Society is pleased to provide access to its recent financial documents and audit results to interested donors and other parties. Auxiliary funds with a carry-forward, surplus or deficit, greater than $1,000,000 at level five of the financial org tree must have a plan to address the surplus or deficit. Written plans approved by each unit’s respective Vice Chancellor Office are due to the campus budget office by October 1st each year. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

It’s possible for fixed assets to have donor restrictions, for example a building that can only be used for a specific purpose, but in this example fixed assets are not restricted. Even if fixed assets are unrestricted, though, they are still not cash nor are they usually easily converted to cash (liquid). The other assets making up net assets are grants receivable of $10,000 and fixed assets of $50,000.

THE UNIVERSITY OF COLORADO SYSTEM

Your message has been received and we’ll be reviewing your request shortly. In the meantime, schedule a meeting with us and we’ll be in touch soon. Take our 2-minute survey to find out if outsourced accounting and bookkeeping is a good fit for your organization.

Reporting on all Boulder campus unrestricted net position based on the prior fiscal year must be submitted to the Board of Regents prior to December 31. We can handle your bookkeeping and accounting to deliver accurate financial statements every month that let you know which money you can spend, for which purpose, and when you can spend it. When you set up funds in your chart of accounts, they’ll show on your financial statements as well. This adds transparency to your finances, but it also makes them a bit harder to read. We’re going to focus specifically on how it’s applied to small and mid-sized nonprofits and charities.

If the donor is gracious enough to agree, the money isn’t restricted. Rarely, a donor may have a personal agenda, or is seeking some type of influence, and is not willing to lift the designation. At this point, the nonprofit can accept the donation and agree to the restriction, or it can refuse the gift altogether. Boulder campus departments are expected to maintain adequate resources to cover expenditures, either budget or revenues as appropriate by fund type. Further, the Boulder campus is expected to employ consistent and proper reporting and categorizing of fund balances.

- AVAILABLE NOW – Great Beginnings for New Nonprofits, a free 8-part email course on fundraising, financial management and other “must know” topics.

- However, unrestricted net position may have internal restrictions/commitments, such as capital projects, academic and research initiatives, financial aid, and other University business.

- Notice that the split between net assets with and without donor restrictions has changed.

- But once you start getting larger donations or grants, fund accounting quickly becomes a necessity.

- An example might be a donation to the Red Cross for emergency aid delivered to Puerto Rico after a hurricane.

Content

You rented your house at a fair rental price from March 15, 2021, to May 14, 2022 (14 months). Your son’s use of the property isn’t personal use by you because your son is using it as his main home, he owns no interest in the property, and he is paying you a fair rental price. Your beach cottage was available for rent from June 1 through August 31 (92 days). Except for the first week in August (7 days), when you were unable to find a renter, you rented the cottage at a fair rental price during that time. The person who rented the cottage for July allowed you to use it over the weekend (2 days) without any reduction in or refund of rent.

- But the depreciation charges still reduce a company’s earnings, which is helpful for tax purposes.

- It is determined based on the depreciation system (GDS or ADS) used.

- It is a simple technique that considers an even amount as a depreciation expense each year.

- For this purpose, treat section 179 costs allocated from a partnership or an S corporation as one item of section 179 property.

- Figure your gain or loss separately because gain or loss on each part may be treated differently.

- The method involves several steps for the calculation of depreciation that need to be applied.

You may have to report the recognized gain as ordinary income from depreciation recapture. See Like-kind exchanges and involuntary conversions in chapter 3. Report gain (other than postponed gain) or loss from a condemnation of property you held for business or profit on Form 4797. If you had a gain, you may have to report all or part of it as ordinary income.

Using depreciation to plan for future business expenses

You must determine the gain, loss, or other deduction due to an abusive transaction by taking into account the property’s adjusted basis. The adjusted basis of the property at the time of the disposition is the result of the following. Under the simplified method, you figure the depreciation for a later 12-month year in the recovery period by multiplying the adjusted basis of your property at the beginning of the year by the applicable depreciation rate. Tara treats the property as placed in service on

August 1. The determination of this August 1 date is explained in the example illustrating the half-year convention under Using the Applicable Convention in a Short Tax Year, earlier.

The machines cost a total of $10,000 and were placed in service in June 2022. One of the machines cost $8,200 and the rest cost a total of $1,800. This GAA is depreciated under the 200% declining balance method with a 5-year recovery period and a half-year convention. Make & Sell did not claim the section 179 deduction on the machines and the machines did not qualify for a special depreciation allowance. The depreciation allowance for 2021 is $2,000 [($10,000 × 40% (0.40)) ÷ 2]. As of January 1, 2023, the depreciation reserve account is $2,000.

What Is Depreciation, Depletion, and Amortization (DD&A)?

Report your not-for-profit rental income on Schedule 1 (Form 1040), line 8j. You generally can’t offset income, other than passive income, with losses from passive activities. Nor can you offset taxes on income, other than passive income, with credits resulting from passive activities. Any excess loss or credit is carried forward to the next tax year. Exceptions to the rules for figuring passive activity limits for personal use of a dwelling unit and for rental real estate with active participation are discussed later.

You choose to postpone reporting your gain from the involuntary conversion. You must report $9,000 as ordinary income from depreciation arising from this transaction, depreciable assets figured as follows. The addition to the capital account of depreciable real property is the gross addition not reduced by amounts attributable to replaced property.

Best Accounting Software for Small Businesses

Instead of including these amounts in the adjusted basis of the property, you can deduct the costs in the tax year that they are paid. You must treat an improvement made after 1986 to property you placed in service before 1987 as separate depreciable property. Therefore, you can depreciate that improvement as separate property under MACRS if it is the type of property that otherwise qualifies for MACRS depreciation.

If you hold the property for the entire recovery period, your depreciation deduction for the year that includes the final quarter of the recovery period is the amount of your unrecovered basis in the property. When using the straight line method, you apply a different depreciation rate each year to the adjusted basis of your property. You must use the applicable convention in the year you place the property in service and the year you dispose of the property. You refer to the MACRS Percentage Table Guide in Appendix A and find that you should use Table A-7a. March is the third month of your tax year, so multiply the building’s unadjusted basis, $100,000, by the percentages for the third month in Table A-7a.

Figuring Depreciation Under MACRS

The remaining amount realized of $100 ($1,100 − $1,000) is section 1231 gain (discussed in chapter 3 of Pub. 544). The fraction’s numerator is the number of months (including parts of a month) in the tax year. You figure the depreciation rate under the SL method by dividing 1 by https://www.bookstime.com/blog/budgeting-for-nonprofits 5, the number of years in the recovery period. The result is 20%.You multiply the adjusted basis of the property ($1,000) by the 20% SL rate. You apply the half-year convention by dividing the result ($200) by 2. Depreciation for the first year under the SL method is $100.

Contents:

Companies can use a trial balance to keep track of their financial position, and so they may prepare several different types of trial balance throughout the financial year. A trial balance may contain all the major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. The key difference between a trial balance and a balance sheet is one of scope. A balance sheet records not only the closing balances of accounts within a company but also the assets, liabilities, and equity of the company. It is usually released to the public, rather than just being used internally, and requires the signature of an auditor to be regarded as trustworthy.

‘Grey’s Anatomy’ : How Kelly McCreary’s Maggie Pierce Left — and Which Couple Called It Quits – Yahoo Entertainment

‘Grey’s Anatomy’ : How Kelly McCreary’s Maggie Pierce Left — and Which Couple Called It Quits.

Posted: Fri, 14 Apr 2023 03:00:00 GMT [source]

Repeat this process as necessary until you get matching totals. A thorough understanding of these documents can reduce your error rate — not to mention your stress levels. There are two primary methods of preparing the trial balance. It is impossible to explain every account to explain the trial balance, but we will try to touch on those examples, which are important and crucial in accounting for every firm.

What is Trial Balance Report | Trial Balance Report Example

If the sum of budgeting reports does not equal the sum of credits, an error has occurred and must be located. Double-entry Accounting SystemDouble Entry Accounting System is an accounting approach which states that each & every business transaction is recorded in at least 2 accounts, i.e., a Debit & a Credit. Furthermore, the number of transactions entered as the debits must be equivalent to that of the credits. In other words, what if total debits don’t equal total credits?

The debit should have been to the utilities expense account, but the trial balance will still show that the total amount of debits equals the total number of credits. The trial balance shows the double-entry rule that ‘for every debit there is a credit’. From the trial balance it can be seen that the total of debit balances equals the total of credit balances. This demonstrates that for every transaction the basic principle of double-entry accounting has been followed – ‘for every debit there is a credit’.

Limits of a trial balance

The first method is to recreate the t-accounts but this time to include the adjusting entries. The new balances of the individual t-accounts are then taken and listed in an adjusted trial balance. Totals of both the debit and credit columns will be calculated at the bottom end of the trial balance. These columns should balance, otherwise, it would likely mean that there has been an error in posting of the adjusting entries. It is a common practice to list the account names in the order they appear on the general ledger of by their respective account numbers.

“How to Blow Up a Pipeline” Poses Terror Threat, Kansas City Intel … – The Intercept

“How to Blow Up a Pipeline” Poses Terror Threat, Kansas City Intel ….

Posted: Tue, 11 Apr 2023 19:40:00 GMT [source]

Here’s how you can complete a https://1investing.in/ of your own. If they are not, your trial balance will serve as a red flag to indicate that something is wrong with your books, allowing you the chance to fix them. Recording the balance of an account incorrectly in the trial balance. Here are some instances of errors in the trial balance. If there is a difference, accountants have to locate and rectify the errors. Match the following characteristic with the financial statement it describes it.

A trial balance is a worksheet used in bookkeeping, that lists the ending balance in all ledger accounts as of a specific point in time (usually as of month-end). It is integrated into most accounting software and used within the accounting department and a source document by the company’s auditors. Even when the debit and credit totals stated on the trial balance equal each other, it does not mean that there are no errors in the accounts listed in the trial balance. We note below several ways in which errors could occur and yet not be spotted by reviewing the trial balance. Add titles to the seventh and eighth columns of the worksheet, which are for the final debit totals and final credit totals. The entries in this column are the original debits and credits, plus or minus the adjusting entries.

What Is a Trial Balance?

The trial balance is so named because it is used as a test to determine if the debits and credits are in balance. If they are not in balance, it indicates that an error has been made. The trial balance is a report that lists the balances of all the individual T-accounts of the general ledger at a specific point in time. Each line item only contains the ending balance in an account. All accounts having an ending balance are listed in the trial balance; usually, the accounting software automatically blocks all accounts having a zero balance from appearing in the report. Edgar Edwards’ bank account in the general ledger has now been balanced off.

Find out more about how Ohio University’s Online Master of Accountancy program strives to prepare students for success as financial professionals. The technical storage or access that is used exclusively for anonymous statistical purposes. The calculation will be the same for the next two periods in the example, including any necessary adjustments.

- Once the errors are located, adjusting entries are posted to the trial balance.

- When two or more errors are committed in such how that the internet effect of those errors on the debits and credits of accounts is nil, such errors are called compensating errors.

- While a trial balance can provide a helpful snapshot of your financial position, it’s not a foolproof method of preventing all possible mistakes.

Balance sheet uses the classic T account format with liabilities on the left side and assets on the right side. In the next activity you will balance off the two accounts that we have not yet dealt with, the liability account ‘Pearl Ltd’ and the capital account. In order to do this you will need to follow the four-point procedure that was used to balance off the bank account. In this activity you will again not enter the answer in a box but will instead have an opportunity to work out the answer mentally before you click on the ‘Reveal answer’ button. The furniture account has a single entry on one side. This amount is the total as well as the balance in the account.

According to a study from Indiana University, roughly 60% of accounting errors come from basic bookkeeping mistakes. You can prevent many of these mistakes by relying on a trial balance to keep track of your financial transactions. Finally, if some adjusting entries were entered, it must be reflected on a trial balance. In this case, it should show the figures before the adjustment, the adjusting entry, and the balances after the adjustment. While we still have not prepared financial statements, we have captured the activity and organized it into a trial balance.

Example of a Trial Balance

No headers The following video summarizes what elements are included in a Trial Balance and why one is prepared. The trial balance is the edit phase of our story before we publish the results in financial statements. Accounts are listed in the accounting equation order with assets listed first followed by liabilities and finally equity. A trial balance is called a trial balance because there will always be equal amounts entered on the debit and credit sides of the ledger. Through trial balance, financial statements can be prepared.

- The debit side and credit side of ledger accounts are added up.

- An error of reversal is when entries are made to the correct amount, but with debits instead of credits, and vice versa.

- This type is used when creating the adjusted trial balance.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

The trial balance summarizes all accounts and balances the totals in the debit and credit columns. When the trial balance is first printed, it is called the unadjusted trial balance. Then, when the accounting team corrects any errors found and makes adjustments to bring the financial statements into compliance with an accounting framework , the report is called the adjusted trial balance. The adjusted trial balance is typically printed and stored in the year-end book, which is then archived.

Some of the instance trial balance errors

An entry could have been made in reverse, where the amount to be debited was actually credited, while the account to be credited was debited. Again, the entry would still balance, and so would not be spotted by reviewing the trial balance. You have now learned how to record transactions in T-accounts. Capital, and each type of asset and liability, has its own T-account. These T-accounts are recorded in the general ledger . Figure 1 below shows the general ledger and the three categories of T-accounts therein that we have discussed so far.

In addition to the above, trial balance performs another important function. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. Generally, the balance sheet is constructed based on the guidelines given by the International Financial Reporting Standards and the U.S Generally Accepted Accounting Principles. The computer and bank loan accounts have single entries on one side, like the furniture account, so they need to be treated in the same way. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. This article will get the clear-cut difference between the Trial balance Vs. Balance sheet Vs. Profit and loss Vs. Income statement.

However, this still does not mean that an error could not exist. The bookkeeper should examine the accounts thoroughly again before proceeding to the next step of creating adjusting entries for the period. To review the debit and credit column totals on the general ledger accounts which match each other and assist you to spot any accounting errors if it holds. If the output finds a mismatch, then there is an error that should be sorted. This type of trial balance prepared once you complete the adjustment entries. It expresses your respective company accounts’ closing balance.

Ledger AccountLedger in accounting records and processes a firm’s financial data, taken from journal entries. This becomes an important financial record for future reference. Ledger in accounting records and processes a firm’s financial data, taken from journal entries.

It is normally prepared at the end of an accounting year. However, an organization may prepare a trial balance at the end of any chosen period, which may be monthly, quarterly, half-yearly, or annually depending upon its requirements. The collection of a $375 account receivable was not recorded at all. Which trial balance will consist of the greatest number of accounts? An error of principle is when the entries are made to the correct amount, and the appropriate side , as with an error of commission, but the wrong type of account is used.

Content

- Delivery notes and copies for oil delivered for the following purposes must bear the statements shown:

- 7 VAT treatment of associated services in warehouse

- VAT on warehoused oil

- Gross capital stocks

- Figure 3: Capital investment in the general government sector is broadly coherent with the national accounts

The Appropriation Act shall allocate funds by vote and any variation in such allocation shall be approved by the National Assembly in a further Appropriation Act. The division of the funds by sub-head and item shall be controlled by the Minister under the authority of Section 5 of the Public Finance Act and any variation in the amount allocated to a sub-head or item by such division shall have the prior approval of the Minister. For purposes of having the control of public money the National Assembly shall be vested with exclusive right to authorise public expenditure, through the approval of annual Estimates of Expenditure and the enactment of Appropriation Acts. If you have other ‘corporanyms’ that you’d like to shareplease send them. ADIDASAfter Dinner I Did A Shit.There seems no earthly reason for this to be funny, but strangely to many, including me, it is.

The SMARTER version below is more powerful and relevant for the moden world because it includes the essential philosophical aspect. Avoid interpretations that include both Achievable and Realistic because the words effectly mean the same so is a waste of a word. (See theSmartie Hunt team building gameand MMM acronym.) See the different SMART and SMARTER posters on theposters page. Other words are used for depending on the situation, listed in the SMARTER entry. The SMART acronym/model is often very effective in conjunction with theAIDA communications model.

Delivery notes and copies for oil delivered for the following purposes must bear the statements shown:

Most “other changes in volume” are calculated by adding or subtracting the change in constant prices to gross fixed capital formation estimates. Industry breakdowns for the general government sector are produced using estimates on a classifications of the functions of government basis and mapping them to the appropriate industry. The asset breakdown of general government GFCF estimates used in the PIM generally align with the national accounts series. Any differentiation between these series is because of the treatment of the transfer of some nuclear power stations, and road de-trunking and the treatment of land, land improvements and transfer costs.

- In reality, the individual customer segment is more profitable, even though the small businesses place more orders annually.

- Sections 541, 543 to 544, 547 to 548, 552 to 553, 558, 561, 563 to 568, 570 to 572, 574 to 577, 579 to 582, 584 to 588, 590 to 605, 607 to 609, 611 to 616, 645 to 648 and 655 to 656 restate various provisions in the 1985 Act but do not make any changes to those provisions.

- The best demonstrations of the Osintot principle are generally provided by leaders and politicians who believe they are somehow immune from its risks, or similarly protected or excused by their chosen god.

- These two measures were recommended by the CLR (Final Report, paragraph 6.39 and ).

- You cannot deliver oils under a marking waiver or submit claims for duty repayment.

Total Quality Management System.Extension of TQM, describing the system by which a company manages Total Quality. Allegedly when the Lockheed Aircraft company introduced their own Total Quality Management System some years ago their engineers devised an alternative meaning -Time to Quit and Move to Seattle. Trailer Park Trash and the shorter Trailer Trash expressions equate in some ways to the UK slangChav, notably in that the slang increasingly describes people of a certain lifestyle or behaviour rather than according to a social class or where they live. Two-Legged https://www.thenina.com/retail-accounting-as-a-way-to-enhance-inventory-management/ Rat.Healthcare acronym referring a little unsympathetically to a patient undergoing treatment of an experimental or desperate nature. This begs the follow-up question as to whether the Dimensions are relative to each other or to time, or to both, or to something entirely different. Essentially it means that the Dimensions In Space are relative to each other, and perhaps also this refers to the fact that the TARDIS time machine was a lot bigger on the inside than the outside – because the inside and outside were in different spatial dimensions (thanks S &D Hiscoke).

7 VAT treatment of associated services in warehouse

The duty requires directors to disclose their interest in any transaction before the company enters into the transaction (subsection ). The duty does not impose any rules on how the disclosure of interest must be made, but subsection allows the disclosure to be made by written notice, general notice or disclosure at a meeting of the directors. Under the current no-conflict rule, certain consequences flow if directors place themselves in a position where their personal interests or duties to other persons are liable to conflict with their duties to retail accounting the company, unless the company gives its consent. A conflict of interest may, in particular, arise when a director makes personal use of information, property or opportunities belonging to the company or when a director enters into a contract with his company. Conflicts of interest may also arise whenever a director makes a profit in the course of being a director, in the matter of his directorship, without the knowledge and consent of his company. Section 232 places restrictions on the provisions that may be included in the company’s articles.

The reference to class meetings in section 374 is dealt with by section 334. There are two main differences from section 378, both of which are drawn from Table A. First, if the demand for a poll is withdrawn, then the chairman’s declaration will stand. Second, the minutes of the meeting also provide conclusive evidence of the chairman’s declaration. This section is intended to provide certainty by preventing members from challenging a declaration of the chairman as to the votes cast on a resolution at a meeting otherwise than by calling a poll. This section expands on article 39 of Table A. It contains the rule that an accidental failure to give notice of a resolution or a general meeting is generally disregarded. Under subsection , this rule can be altered by the articles in some but not all cases.

VAT on warehoused oil

If the contract is not in writing, the company must keep available for inspection a written memorandum of its terms. This section, together with sections 229 and 230, replace section 318 of the 1985 Act. These sections replace section 319 of the 1985 Act and require member approval of long-term service contracts. In broad terms, these are contracts https://www.globalvillagespace.com/GVS-US/main-features-of-bookkeeping-and-accounting-in-the-real-estate-industry/ under which a director is guaranteed at least two years of employment with the company of which he is a director, or with any subsidiary of that company. Section 66 of the Charities Act 1993 renders prior authorisation by the members for certain transactions invalid unless the Charity Commissioners have given their prior written consent.

What are the two classes of inventory in accounting?

Two types of inventory are periodic and perpetual inventory. Both are accounting methods that businesses use to track the number of products they have available.

Contents:

We are the best in the Oklahoma market centering our operations in south Tulsa. E3 Bookkeeping makes sure our clients have the best books at the end of the month and the end of the year. Our team is experienced, prepared, and most importantly, looking out for you and your business. Are you looking to save money and get your finances in order?

Prohibition on provision of accountancy services to Russia comes … – economia

Prohibition on provision of accountancy services to Russia comes ….

Posted: Thu, 21 Jul 2022 07:00:00 GMT [source]

As a small business owner, you may want to provide your employees with some form of health insurance. With the Canada Summer Jobs program, each year, the Canadian government is determined to help students and business owners succeed…. If you’re not sure where to start, these best practices can help. Lastly, you’ll want to write tips, advice, and answers to questions for accounting students. Again, write on these types of blog posts and also create youtube and tik tok videos around it. It might be hard to rank a blog for a broad topic to a potential business owner, so our goal is to target long tail keywords & niche keywords.

How to File Your Delaware Franchise Tax On Time

JR https://bookkeeping-reviews.com/ is a full-service accounting firm in Ventura, CA, providing financial peace of mind so you can focus on growing your business. Befree is one of the largest bookkeeping companies in Australia. Befree was established by accountants in 2006 to meet the ever growing shortage of quality bookkeeping service providers. Keep up to date with the latest bookkeeping and accounting trends with the LedgersOnline blog updated weekly by accountants and bookkeepers. Our Mission is to provide a comprehensive remote bookkeeping and accounting service, that is convenient, secure, reliable, affordable.

It’s amazing to look back and see how much technology has changed in the past few years. The number of apps and platforms we work with just keeps growing as the tools get better and better for small businesses. You need help with accounting, but… You’re not sure who to ask for help. Accountants, CPAs, and bookkeepers all want your business. Can anyone throw out a shingle and claim to be a… Saving money can be overwhelming and realizing that you need to be on a stricter budget is a hard thing to understand.

Sales tax is one of those things that seems like it shouldn’t be a big deal. Simply collect the sales tax and figure out how to send it in. A lot of times people don’t even do that – they just make the sale and then worry about the sales tax later. Congratulations, your business is adding its first employee!

Most business owners consider stable and optimized cash flow to be their main metric for success. The second type of blog post is to write guides for people starting businesses in other niches. Whatever you do, only allow helpful, quality, engaging and really meaningful blog posts stay on your bookkeeping business blog & website. If you focus on your online content, your bookkeeping business will rank in google & you’ll get highly qualified bookkeeping clients.. 6 min read We start businesses in order to make money and provide a needed service to people while doing something we love.

Business Challenges That Can Be Solved With Outsourced CFO Services

As your business grows, financial tracking builds repour. Utilize your weekly dashboards and monthly financials to create a rolling tracking sheet to analyze the trends in your business across larger timespans, like 12… Outsourcing your bookkeeping services has never been so accessible and compelling than it is… Cloud-based technology has altered how modern-day businesses operate.

There is a lot of professional terms around finances, and they can be kind of daunting when trying to understand! We have created a list that is going to make knowing your numbers a breeze! These reports in turn allow you to analyze your business and make educated financial decisions. Too many people blindly run their business, not even knowing if they are making a profit or not. As provinces across the country get set to begin the reopening process, business owners and self-employed individuals are getting ready to ramp up their… Recapping episode 1 in our first blog post, we talked about a process to think about and create your own company processes.

Read through for the common categories, and my recommendation. Operating a business or company comes with a variety of demands. Whether you’re a growing business or a scaling company, your operation needs many sides of it to be addressed and managed to find success. Things like long-term growth, employee retention, and invoice…

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

Everyone says you should get QuickBooks…but should you? Read on for instructions to DIY your books from a workshop I’ve done for freelancers, in way less time than you think it will take. Not sure how long to keep your business records on file? So your bookkeeping is getting done each month, whether by yourself or an outsourced bookkeeper, but now what?

Successful CEO Day Guide

You shouldn’t feel ashamed or alone in your money… Monthly Bookkeeping | Your books handled by eCommerce experts. Cash helps in performing day to day business activities…. As an entrepreneur or manager/owner of a busy small to medium-sized enterprise, it’s essential that you use tools to. BooxKeeping CEO Max Emma shares his insights on how to select a bookkeeping partner for your franchisees in the latest episode of The Supplier Wire podcast by Modrn Businss.

This comparison of a popular DIY exporting cryptocurrency transactions to xero product and Bench’s full-service online solution will help you choose which is best for your small business. One of Bench’s partners, tax professional and Enrolled Agent Adam Short, shares why bookkeeping is so important to the tax resolution process. Write about accounting products, software and services. You can write articles that help, by listing out recommendations of the tools, software and products you use that pertain to business or accounting. So if you write an encouraging and helpful article to people starting a business in a niche and region, there’s a high likelihood that you’ll rank. This works so well that Feedbackwrench’s websites for accountants website has begun to rank in the accounting serps here locally.

You can be a profitable business (by showing positive… I’m the type of person who likes to sit and enjoy the episode in the moment and then once it’s done, I’ll do a little… So many repercussions occurred from various decisions during this episode that reverberate across the… As a company grows from a small company to a medium-sized one, you may need a few upgrades to your… You should also be able to write pretty easily about this subject matter, so it’s worthy ou cranking it out.

Discover how a Friday afternoon ritual brings together members of the marketing team . Discover how to truly rest and make time for self-care and self-love while running a business. Get our agenda that we’ve used to build 6, 7, and 8 figure businesses. Preparing and filing taxes can be a real hustle to deal with.

Simple Explanation of Cash and Accrual Accounting

Since no one on your team is officially tasked with it, it tends to fall on your shoulders. (Like so many other things when you’re a small business owner!) That means accounts are reconciled… It’s easy to overlook this when you’re starting, but you must also keep track of your cash payments. Before spending money on business products, any cash the company receives must be deposited into the company’s bank account. It’s tempting to use cash immediately to buy supplies, but this can easily derail your bookkeeping system. When recording cash payments, please keep track of who paid, so you don’t have to chase them down later.

OACC Business Spotlight: Busy Bee Accounting Services – Sierra News Online

OACC Business Spotlight: Busy Bee Accounting Services .

Posted: Wed, 05 Oct 2022 07:00:00 GMT [source]

In some cases, they have to make impossible decisions. Most of the time, they decide to keep the doors open at any cost. This cost could be business shrinkage, employee layoffs, customer… As an Owner or Executive, you’re used to taking control and making decisions.

Noah had a start-up and needed to reduce costs

CPA Steve authors posts on everything from the self-employed to client bullying. Top entries include insulting an IRS auditor and how improvements in small business can be deducted. Because certified public accountants are on the cutting edge of business strategy, professional services, and staffing issues, there is this blog. It is run by the Maryland Association of CPA’s and tells those stories. A recent entry was on how accountants and bookkeepers can earn loyal clients. “blog post ideas” is much harder than “Blog post ideas for bookkeeping businesses”.

Learn how to keep track of business expenses the right way with this practical guide, including best practices, tips, and the latest technology tools. I know when I first started my business, I could not afford to have my bookkeeping outsourced. If you are starting your business and need some bookkeeping skills, check out accountinged.com, they have free classes and a free trial and a pretty reasonable subscription. There are so many benefits to be gained by taking control of your bookkeeping in the early stages of your blog. Taking control will save you time, money, and end of year tax time stress.

Many business owners believe that if their books are managed by a professional, they do not need to learn about tax and accounting rules. You may even feel that way if you use automated accounting software. However, while these assets reduce your chances of having tax problems, it is best to be aware of your tax obligations.

Content

For example, excel has virtually any bookkeeping template you would want. These include a general ledger, an income statement, a balance sheet, a cash flow statement, and so much more. Use the journal entry template to record all financial transactions. Enter the date, account name, transaction type, and amount for each transaction. Then, use formulas to calculate the totals for each account automatically.

- Pivot TableA Pivot Table is an Excel tool that allows you to extract data in a preferred format (dashboard/reports) from large data sets contained within a worksheet.

- Excel accounting templates can help reduce errors and improve accuracy in financial record-keeping.

- Simply click the button on the cell, type the sum into the box, and then press Enter.

- It has app access for use on the go, with many providers allowing you to capture photos of expense receipts through the phone.

- This email is sent to the email address you’ve provided on the checkout page.

It is a simple and cost-effective way to manage their financial records. A general ledger is a record-keeping system that tracks all financial transactions for a business. These include revenue, expenses, assets, liabilities, and equity.

Etsy Sellers Bookkeeping Excel Spreadsheet

Excel accounting templates are customized to meet the specific needs of a business. For example, templates are modified to track specific expenses or create reports tailored to a business’s unique financial situation. Other features of an accounting template may include a general ledger, accounts receivable and payable, and inventory management. https://www.world-today-news.com/accountants-tips-for-effective-cash-flow-management-in-the-construction-industry/ These features help users to keep track of transactions, manage customer and vendor accounts, and monitor inventory levels. Small businesses, freelancers, or individuals can use Excel accounting templates to manage their financial records. The templates are easy to use and can be modified to reflect the unique requirements of each user.

- Creating a cash flow statement in Excel can provide a clear and concise understanding of a company’s cash flow over time.

- Printable and dynamic dashboard with easy-to-fill tables.

- Excel is good enough for basic accounting for small businesses.

- Get a sales invoice template right now and see for yourself.

Managerial accounting is similar to financial accounting. But instead of looking at various accounting dates, it focuses on monthly or quarterly reports. For example, there’s a General Ledger Template for you to track any business expense, a Statement of Account Template, Credit Card Tracker Template, invoice templates, and more. You may want to make a copy of each one at the end of the month, and either save it or upload it to the cloud. Come tax season, your accountant will need your income sheets for the year.

What are some examples of Excel accounting templates?

While Excel accounting templates can be customized to some extent, they have limited features compared to dedicated accounting software. This may make it difficult to perform complex accounting tasks or generate detailed financial reports. A list of all the accounts that are used to record financial transactions is called a chart of accounts. Create a new worksheet in Excel and list all the accounts you will use to track your financial transactions. These can include cash, accounts receivable, accounts payable, and expenses.

Accounting software, on the other hand, is designed specifically for bookkeeping and provides more advanced features than Excel. It automates much of the data entry and processing, reducing the risk of errors and ensuring accuracy. Some templates come with pre-defined categories, while others allow the user to create their own categories. Categories should obviously differ between small businesses and large businesses.

Single Entry Bookkeeping in Excel

Enter the starting date for the week at the top of the template, and the dates will automatically populate the timesheet. View hourly rates, total hours, and total pay for each day and week. Use this mileage log template to track business vehicle use and mileage costs. The template includes columns for travel dates and purpose, starting and ending points, odometer readings, and total miles. If you are using this sheet to reimburse employees, enter the reimbursement rate at the top of the template to determine the total amount owed. Create a detailed report that displays quarterly cash flow projections.

Accountant Job Description Guide: Building a Strong Team with … – Small Business Trends

Accountant Job Description Guide: Building a Strong Team with ….

Posted: Sat, 15 Apr 2023 21:00:53 GMT [source]

Furthermore, they can also calculate ratios such as the debt-to-equity ratio or the current ratio. This is especially so for small businesses or individuals with basic accounting needs. It can also be customized to suit the unique requirements of each user.

First: What Excel can and can’t do

The main characteristic of petty cash is in its nominal amount. If you know what you’re doing, it’s possible to perform all of the core accounting functions for a business on Excel. Learn real estate bookkeeping how to dump spreadsheets and outsource your bookkeeping. Data entry – Manually entering and categorizing transactions for your books is starting to take up too much of your time.

Content

You can even calculate an employee’s annual gross and net wages. Payroll deductions include federal, state, and local income tax; Social Security tax; and Medicare tax. Non-tax deductions include health insurance premiums, retirement plan contributions, and wage garnishments. If you’re a salaried employee with one income source, your gross pay is your annual salary before taxes. If you’re an hourly employee with one income source, you can multiply the number of hours you work by your hourly rate to find your gross pay. For example, if you work 35 hours a week and have a $25 hourly rate, your gross weekly pay would be $875.

Designer Brands Inc. Reports Fourth Quarter and Fiscal Year 2022 … – PR Newswire

Designer Brands Inc. Reports Fourth Quarter and Fiscal Year 2022 ….

Posted: Thu, 16 Mar 2023 10:45:00 GMT [source]

This is the Gross Pay Versus Net Pay that the employer indicates on the employment contract. For instance, if the employer has offered to pay you an annual salary of $60,000, you will earn $60,000 in gross pay. Net pay is the amount you receive via check, direct deposit, or another payment method.

Gross pay vs. net pay — Definition, calculation, key differences

Once you have an employee’s tax status, you can determine the mandatory taxable amount to take from their paycheck. She is paid bi-weekly and worked 40 hours a week for the past two weeks. All you need is a mixed colored bag of candy (like M&M’s or skittles). Pour the candy into a bowl and tell your child to pretend this is a gross paycheck. Then tell the child they must take out all the yellow candies for taxes and Social Security, and the green candies for healthcare coverage. Payroll is the compensation a business must pay to its employees for a set period or on a given date.

How do I calculate net to gross?

- Convert the tax from net rate from a percentage to a decimal number, e.g., 12% = 0.12 .

- Multiply the tax rate by the net price.

- Add the result to the net price.

- You've obtained the gross value by applying the tax to the net value.

The current https://quick-bookkeeping.net/ tax rate is 6.2% for employees and employers, with a wage base limit of $142,800 . To obtain net pay, add together all mandatory and voluntary deductions and subtract this from gross pay. No, nothing is deducted from the gross pay amount before calculating net pay. If employers have a contract with an employee to earn $170,000 per year and they get paid bi-weekly, the gross amount per paystub will always be $6,538. Any payroll manager anywhere will always see gross and net pay on their payslip and their employees’ payslips. That’s why not only understanding the difference between the two, but how to calculate each is non-negotiable for businesses to avoid liabilities and remain compliant.

What is “gross salary”?

Common voluntary deductions include retirement contributions, health and dental insurance premiums, and union dues. For employees, these deductions help to reduce their taxable income and overall tax burden while allowing them to enjoy certain long-term benefits. You need to know an employee’s gross pay to calculate net pay. And, you must know the employee’s gross wages to determine their tax liability. To find net pay, subtract deductions from the employee’s gross wages. Your gross income includes more than just your wages or salary.

Gross pay and net pay sound interchangeable, but as you can see from these examples, they’re anything but. The difference between a person’s initial gross pay and their take-home pay could be vast, depending on their deductions and withholdings. Erin Ellison is the former Content Marketing Manager for OnPay.

How to calculate gross pay for salaried employees

In film production, that contract is usually activated as a crew deal memo, but it’s form and language will change from situation to situation or industry to industry. This post will discuss gross and net pay differences and how they affect your payslip. We’ll contact you to schedule a call, answer any questions you may have, and start onboarding your employees. Time & Attendance Automate the process of tracking work hours accurately.

Contents:

Reuters.com Platform Analyze data to detect, prevent, and mitigate fraud. Focus investigation resources on the highest risks and protect programs by reducing improper payments. ID Risk Analytics Analyze data to detect, prevent, and mitigate fraud. It’s always a good idea to run your favorite spellcheck app on your resume before submitting it. Make sure to double-check your writing or have someone else help you out.

To set yourself up for a successful job interview, it may be a good idea to do a mock interview to practice what you’ll say and review some of the questions you could be asked. First, based on the items you told your client you would do for them, create a workflow of what you need to do each week or month, and when it needs to be completed. Bookkeepers frequently use spreadsheets to record financial data; therefore, knowing how to use spreadsheet tools can be helpful for bookkeepers. A bookkeeper should be able to create a basic spreadsheet for everyday tasks like keeping track of an account’s details or listing a group of fixed assets.

How much should a CPA charge for taxes?

Starting a business is filled with new and challenging decisions. However, once the business is up and running, it’s common to be unprepared for typical day-to-day operations. Anticipating these concerns helps make sure you’re working as efficiently as possible. Small firms tend to be much more agile and have a greater ability to do new things. HighQ A business management tool for legal professionals that automates workflow.

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

No matter what type of job or company you’re interviewing for, the hiring manager will likely ask you a few of the most common open-ended interview questions. These questions will help break the ice and allow you to shine early on in the job interview. So, you might be thinking, how can I get a job as a bookkeeper? Well, the first step in finding rewarding work in the field of bookkeeping is getting through the hiring process and standing-out among other job applicants by acing your job interview.

Crunching Numbers… While Crushing Your Career Goals

It never hurts to talk to a pro about what you’re noticing. First, make sure you meet all of the qualifications and that your QuickBooks Online Certification is up to date. Once you apply online, a recruiter will contact you and complete a phone screen. If you continue the process, someone will contact you to set up additional interviews with our team. Just as you will advise all your prospective clients to implement good business processes and systems, you should do the same. It’s easier to implement processes at the beginning than trying to put out fires when you get too busy.

status levels your abilities based on knowledge is not only good for your business but is ultimately valuable for your clients as well. Frankly, finding and keeping staff is a significant challenge, which is why hiring always leads industry surveys about common needs and concerns. Even if you aren’t ready to hire a team, it’s wise to start developing a strategy early. As you build your client list, keeping costs low is a priority. Not only does it allow you to see a profit early, but it also allows you to adjust your service menu to attract clients with lower-than-normal prices. All the regulations that apply to a physical location also apply to virtual or home offices.

How much should you expect to spend on a bookkeeper?

When you use these financial documents together, they offer a full and accurate picture of your business’s overall health. From the first step to the last, the right bookkeeping company has established procedures that create trust and security for the client. We take away motives, we take away opportunities, and we leave business owners with greater peace-of-mind about the trustworthiness of their bookkeeping team.

With updated and accurate financial documents in hand, you can easily find growth opportunities and spot issues that may be draining resources. Thoroughly understanding and maintaining these documents also prepares you for critical conversations with potential lenders and investors. Did you know that 82% of small business failures are due to cash flow problems? Regularly reviewing your cash flow statement goes a long way in keeping your business on the positive side of that statistic. It’s not unusual for your business to show a loss at various times, like when you’re launching a new product or expanding your location.

And while there are accounting-specific requirements, it’s important to remember that you’re starting a business first. Self-motivated individual with ability to develop efficient systems for precise accounting of financial transactions. Proficient in mathematics and statistics, highly organized, and a self-starter. Expertise in producing accurate and reliable financial statements.

Most business owners hire a bookkeeper because they don’t have the time or knowledge to maintain and balance their own books. They are unlikely to spot errors in the event of company fraud. I have a dream to help several number of other companies having bookkeeping challeges. I started my journey to this dream by drafting some 2 paged idea plan of bookkeeping business however my plan was sketchy and was missing alot. I want to be self employed in my proffession but one who fits in the 21st century technology. You will definitely want to check this system out as an option as it’s incredibly popular for bookkeeping businesses and accounting firms.

Again, with remote meetings, https://bookkeeping-reviews.com/ important that your clients and team can see you very clearly. By presenting your pricing and service options in a second meeting, you’ll be able to engage in a discussion around picking and selecting the right option for your client. Now you need to find new clients with a simple, repeatable sales process.

Missouri farmer, 80, boasts one of the world’s longest lasting … – UCHealth Today

Missouri farmer, 80, boasts one of the world’s longest lasting ….

Posted: Thu, 29 Sep 2022 07:00:00 GMT [source]

Since then I have been the driving force behind many bookkeeping business success stories. You are wanting to get off the treadmill of trading time for money and create a business and a lifestyle that you love. If you want a real business that has high retainer clients, then you’ll need to prospect. Alright, if you go to a service like Sales Genie, you can get a list of businesses leads that you can then professionally call on. Use in social media messaging – These videos can be made into social media posts and advertising that really covers the core facets of how you help people.. A Video Sales Letter is a video you’ll put on your website that will position yourself to potential clients, rather than requiring people to read all your website and advertising copy.

Why this Texas designer rebranded her markup – Business of Home

Why this Texas designer rebranded her markup.

Posted: Sun, 13 Nov 2022 08:00:00 GMT [source]

C) help managers evaluate the financial condition of the firm. Help stakeholders evaluate the financial condition of the firm. Summarizing and interpreting company financial information.

Fortunately bookkeeping software makes this task easier than you might have thought. I was able to grow my public accounting firm quickly by hiring certified public accountants and professional bookkeepers thanks to many of the marketing strategies that worked well. For example, some small business owners do their own bookkeeping on software their accountant recommends or uses, providing it to the accountant on a weekly, monthly or quarterly basis for action. Other small businesses hire a bookkeeper or employ a small accounting department with data entry clerks reporting to the bookkeeper.

Not only is bookkeeping a rewarding job in and of itself, but it can also open a world of opportunities, leading to career advancements and professional growth within the business and financial industries. Bookkeepers often grow into positions as accountants or financial managers, which rank among the top 20 highest paying jobs in Boston. Whether you are just starting your business or have an established business, you are in the right place. If you are a bookkeeper or virtual assistant who wants to learn more about business finances to start, grow or scale your bookkeeping business, you too will benefit from this podcast. At the University of Potomac, we can lead you towards a successful career as a bookkeeper. Through our program in Bookkeeping Administration, we prepare you to take the QuickBooks Certified User certification exam.

Content

Therefore, if one spouse earns income in excess of $1,000,000 and the other does not, it would make sense to consider shifting investment assets into the name of the other spouse. The new capital gains tax law did not change the rules prohibiting the deduction of certain capital losses. Capital losses that are disallowed as a deduction under Code § 165 , § 262 or § 267 are not deductible for Massachusetts state tax purposes. For example, losses on the sale or exchange of collectibles that are held for personal use are not deductible. Although the law is fairly lenient on residency times for marriages, it is not so lenient on previous exclusion uses. Previous marriages are a vital consideration when it comes to real estate capital gains taxes.

This deduction can come from living in the home two out of the last five years. In 2009, a law was put into effect that closed a tax loophole in the capital gains tax law. The code is known as the 2008 Housing and Economic Recovery Act. The law was put into effect as a means of preventing wealthy homeowners from avoiding paying taxes.

Taxachusetts Redux? The New Massachusetts Millionaires Tax

The final exemption to paying capital gains taxes is using a 1031 exchange. This is basically a code that allows the seller of the home to reinvest the money from the sale of the home into buying another home. In order for this to create an exemption, you must reinvest the money within 45 days of the sale of the home. This code can also be used for some corporations and LLCs as well. There are instances when the capital gains tax rate is 5.1%, but those rates specifically apply to different schedules.

Don’t let this catch you by surprise and create a financial burden. Consult with an accountant or tax advisor before selling an inherited property. Also consider the above methods for reducing or deferring taxes. Knowing your options and what to expect will allow you to save money and make better decisions. Asset selection and tax-advantaged financial products may also help mitigate the additional tax.

Basic planning for individuals—spreading and accelerating

Investment income realized from interest, dividends and long-term capital gains is taxed at the more favorable rate of 5.0% (2020, 5.05% in 2019). Investment income realized from short-term capital gains is taxed at the less favorable rate of 12.0%.Add your investment income from interest, dividends and long-term capital gains. This is your Net Massachusetts Investment Income.Add your investment income from short-term capital gains. This is your Net Massachusetts Short-Term Capital Gains Income. If a couple has substantial unearned income, that income could be spread between the spouses to ensure that each makes full use of the first $1,000,000 of income that is free of the additional tax.

- And many taxpayers may not even realize the extra tax will apply to them.

- You may also combine your cost basis and improvement costs to reach the $250,000.

- The law’s modification says that the gain may not be excluded for periods of “non-qualified use,” mostly when the home was not used as the taxpayer’s primary residence.

- Some things can be done in 2022 to accelerate income into the current year, while others include opportunities for 2023 and beyond.

- Our team is here to help you sell your house fast on your terms and avoid a long, drawn-out process.

- 10 percent for single filers up to $10,275, up to 20,55o for married filing jointly, and up to $14,650 for the head of household.

Currently, the Massachusetts tax rate on wages, long-term capital gains, dividends, interest and other income, is 5% for all taxpayer income levels. If voters approve the ballot measure, the Massachusetts tax rate on income in excess of $1 million will increase by 4%. Substantively, the Millionaires’ Tax has a multitude of consequences. The latter is among the highest personal income tax rates on short-term capital gains in the nation. Because Massachusetts taxes short term capital gains at 12%, the effective new tax rate on this income will be 16%.

Requirements For Taking Real Estate Capital Gains Tax Deduction

For example, does massachusetts have state income tax in assets that generate income that is exempt from state tax, such as many Massachusetts municipal bonds, may become more attractive. Private placement life insurance and private placement variable annuities , may also become more attractive simply because the income tax deferral, and in some cases tax elimination, that they provide will become more valuable. Although higher household income is often something families strive for, with the passage of the Massachusetts Millionaires Tax on November 8, 2022, having taxable income in excess of $1 million has become less attractive for 2023 and beyond. There is a new law that just went into effect as of January 1st 2009 that closes a tax loop hole in the Capital Gains law. The recently signed 2008 Housing and Economic Recovery act has placed new restrictions on wealthy home owners who own two or more homes and plan to hop from one home to another to avoid paying capital gains.

In contrast, Massachusetts taxes income of an individual who is neither domiciled in Massachusetts nor a resident of Massachusetts only to the extent the income derives from a Massachusetts source. An individual could therefore escape the taxing authority of Massachusetts over non-Massachusetts source income by changing his or her domicile and ending his or her residency in the Commonwealth. Avoid Massachusetts income tax altogether on non-Massachusetts-source income by moving out of Massachusetts.

Sign Up for Weekly Investment Insights

This is a general communication should not be used as the basis for making any type of tax, financial, legal, or investment decision. The simple examples above only illustrate the state tax impact, but federal tax implications will also apply. Further, both examples ignore other sources of income, such as wages, pre-tax retirement account distributions, dividends, etc., that could increase the tax due from the surtax. So, the millionaire’s tax is already here for residents of Massachusetts and may soon be here for residents of California, Connecticut, Hawaii, Illinois, Maryland, New York, Oregon, and Washington and lost likely more.

Because accounting also creates the trial balance, income statement, and balance sheet from looking at the ledger. The journal is often considered more important than the ledger because if it is done wrong, the ledger cannot be done correctly. As long as the journal is recorded accurately, the ledger will follow.

FreshBooks vs Xero: 2023 Accounting Software Comparison – TechRepublic

FreshBooks vs Xero: 2023 Accounting Software Comparison.

Posted: Wed, 17 May 2023 07:00:00 GMT [source]

Let’s say you buy $1,000 worth of commodities from Company XYZ in your editions, you require to debit your Purchase Account and credit Company XYZ. Because the provider, Company XYZ, is giving goods, you are required to credit Company XYZ. Then, you require to debit the receiver, that is your Purchase Account. If the grand total in the Trial Balance is not equal for both the Debits and the Credits, something is missing or not entered correctly in the General Ledger. Our review course offers a CPA study guide for each section but unlike other textbooks, ours comes in a visual format.

Debit expenses and losses, credit income and gains

The general ledger is simply a collection of all T-accounts for a business, providing both the activity and balances of all accounts within the business. Posting refers to the process of transferring data from the journal to the general ledger. It is important to understand that T-accounts are only used for illustrative purposes in a textbook, classroom, or business discussion.

Diffzy is a one-stop platform for finding differences between similar terms, quantities, services, products, technologies, and objects in one place. Our platform features differences and comparisons, which are well-researched, unbiased, and free to access. Get up and running with free payroll setup, and enjoy free expert support.

What is the difference between a ledger and a trial balance?

The transactions pertained to several accounting components, including liabilities, assets, equity, expenses, revenues, gains, and losses. With double-entry accounting, your credit and debit totals should balance because each transaction has equal but opposite effects on at least two accounts. The trial balance is a tool to confirm the correctness of entries in the general ledger.

- In bookkeeping systems, the accountant can then run a trial balance report, and it will summarize all of the activity (debits and credits) to each trial balance account.

- As they grew, the owners found that they needed to create sub ledgers to better understand their finances without wading through dozens of transactions in the general ledger.

- General Ledger (GL) accounts comprise all credit and debit transactions influencing them.

- Despite not being able to detect all errors, the trial balance serves three important functions.

Accountants may differ on the account title (or name) they give the same item. For example, one accountant might name an account Notes Payable and another might call it Loans Payable. Both account titles refer to the amounts borrowed by the company. The account title should be logical to help the accountant group similar transactions into the same account. Once you give an account a title, you must use that same title throughout the accounting records. Whichever option you choose, the important thing is that each transaction is posted correctly and the accounts are balanced each month.

What are the features of a ledger?

Running a business means juggling a variety of financial reports, like your company’s trial balance and general ledger. With so many reports to look through, you may be asking yourself, What do these reports mean, and how do I use them? Take a look at the difference between general ledger vs. trial balance and how to use the reports to your advantage.

The main purpose of a trial balance is to ensure that all the debits and credits recorded in the general ledger are in balance (i.e., the total debit balances equal the total credit balances). The trial balance is a report run at the end of an accounting period, listing the ending balance in each general ledger account. Despite not being able to detect all errors, the trial balance serves three important functions. First it summarises in one place all accounts of a business and their respective balances, and it is from these balances that form the basis on which the financial statements are prepared.

What is the Difference Between General Ledger and Trial Balance?

Revenue can comprise interest, sales, royalties, or any other fees the company collects from other individuals. Liabilities are recent or future monetary debts the corporation has to pay. Current liabilities can comprise things like worker salaries and taxes, and coming liabilities can encompass things like lines of credit or bank loans, and leases or mortgages.

- Preparing general ledger and trial balance are two prime actions in the accounting cycle which are necessary for the preparation of year-end financial statements.

- But when she looks at the trial balance, the debits and credits don’t match.

- It is important to note that the trial balance is unable to detect all recording errors.

All the debit balances will be recorded in one column with all the credit balances in another. The trial balance is usually set up by an accountant or auditor who has used daybooks to record financial transactions and forwarded them to self-reported ledgers and personal book accounts. Experimental balance is part of a dual accounting system that uses and uses the old ‘T’ account format to present values.

But he had a trial balance, so he quickly spotted the mistakes and fixed them. Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500. QE Food Stores is a chain of grocery stores in Sydney that carries a variety of staple items such as meat, milk, eggs, bread, and so on. As a smaller grocery store, QE Food Stores do not offer the variety of products found in a larger supermarket chains such as Woolworths and Coles.

Understanding General Ledger vs. General Journal – Investopedia

Understanding General Ledger vs. General Journal.

Posted: Sat, 25 Mar 2017 07:41:23 GMT [source]

The trial balance double-checks the ledger by summarizing account balances, and making sure the debits match the credits. The general ledger is the primary accounting record of a company. It organizes all transactions by account, providing a record of each transaction that affects each account.

To retain the accounting equation’s net-zero discrepancy, one asset account must enhance while another reduces by the same quantity. The recent balance for the cash account, after the net change from the transaction, will then be reported daily contract rates reflected in the balance category. It is no secret that the realm of accounting is operated by debits and credits. Before we hop into the golden doctrines of accounting, you require to brush up on all things credit and debit.