What is the difference between a ledger and a trial balance?

Because accounting also creates the trial balance, income statement, and balance sheet from looking at the ledger. The journal is often considered more important than the ledger because if it is done wrong, the ledger cannot be done correctly. As long as the journal is recorded accurately, the ledger will follow.

FreshBooks vs Xero: 2023 Accounting Software Comparison – TechRepublic

FreshBooks vs Xero: 2023 Accounting Software Comparison.

Posted: Wed, 17 May 2023 07:00:00 GMT [source]

Let’s say you buy $1,000 worth of commodities from Company XYZ in your editions, you require to debit your Purchase Account and credit Company XYZ. Because the provider, Company XYZ, is giving goods, you are required to credit Company XYZ. Then, you require to debit the receiver, that is your Purchase Account. If the grand total in the Trial Balance is not equal for both the Debits and the Credits, something is missing or not entered correctly in the General Ledger. Our review course offers a CPA study guide for each section but unlike other textbooks, ours comes in a visual format.

Debit expenses and losses, credit income and gains

The general ledger is simply a collection of all T-accounts for a business, providing both the activity and balances of all accounts within the business. Posting refers to the process of transferring data from the journal to the general ledger. It is important to understand that T-accounts are only used for illustrative purposes in a textbook, classroom, or business discussion.

Diffzy is a one-stop platform for finding differences between similar terms, quantities, services, products, technologies, and objects in one place. Our platform features differences and comparisons, which are well-researched, unbiased, and free to access. Get up and running with free payroll setup, and enjoy free expert support.

What is the difference between a ledger and a trial balance?

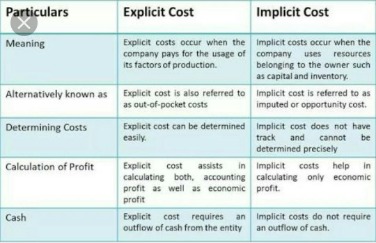

The transactions pertained to several accounting components, including liabilities, assets, equity, expenses, revenues, gains, and losses. With double-entry accounting, your credit and debit totals should balance because each transaction has equal but opposite effects on at least two accounts. The trial balance is a tool to confirm the correctness of entries in the general ledger.

- In bookkeeping systems, the accountant can then run a trial balance report, and it will summarize all of the activity (debits and credits) to each trial balance account.

- As they grew, the owners found that they needed to create sub ledgers to better understand their finances without wading through dozens of transactions in the general ledger.

- General Ledger (GL) accounts comprise all credit and debit transactions influencing them.

- Despite not being able to detect all errors, the trial balance serves three important functions.

Accountants may differ on the account title (or name) they give the same item. For example, one accountant might name an account Notes Payable and another might call it Loans Payable. Both account titles refer to the amounts borrowed by the company. The account title should be logical to help the accountant group similar transactions into the same account. Once you give an account a title, you must use that same title throughout the accounting records. Whichever option you choose, the important thing is that each transaction is posted correctly and the accounts are balanced each month.

What are the features of a ledger?

Running a business means juggling a variety of financial reports, like your company’s trial balance and general ledger. With so many reports to look through, you may be asking yourself, What do these reports mean, and how do I use them? Take a look at the difference between general ledger vs. trial balance and how to use the reports to your advantage.

The main purpose of a trial balance is to ensure that all the debits and credits recorded in the general ledger are in balance (i.e., the total debit balances equal the total credit balances). The trial balance is a report run at the end of an accounting period, listing the ending balance in each general ledger account. Despite not being able to detect all errors, the trial balance serves three important functions. First it summarises in one place all accounts of a business and their respective balances, and it is from these balances that form the basis on which the financial statements are prepared.

What is the Difference Between General Ledger and Trial Balance?

Revenue can comprise interest, sales, royalties, or any other fees the company collects from other individuals. Liabilities are recent or future monetary debts the corporation has to pay. Current liabilities can comprise things like worker salaries and taxes, and coming liabilities can encompass things like lines of credit or bank loans, and leases or mortgages.

- Preparing general ledger and trial balance are two prime actions in the accounting cycle which are necessary for the preparation of year-end financial statements.

- But when she looks at the trial balance, the debits and credits don’t match.

- It is important to note that the trial balance is unable to detect all recording errors.

All the debit balances will be recorded in one column with all the credit balances in another. The trial balance is usually set up by an accountant or auditor who has used daybooks to record financial transactions and forwarded them to self-reported ledgers and personal book accounts. Experimental balance is part of a dual accounting system that uses and uses the old ‘T’ account format to present values.

But he had a trial balance, so he quickly spotted the mistakes and fixed them. Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500. QE Food Stores is a chain of grocery stores in Sydney that carries a variety of staple items such as meat, milk, eggs, bread, and so on. As a smaller grocery store, QE Food Stores do not offer the variety of products found in a larger supermarket chains such as Woolworths and Coles.

Understanding General Ledger vs. General Journal – Investopedia

Understanding General Ledger vs. General Journal.

Posted: Sat, 25 Mar 2017 07:41:23 GMT [source]

The trial balance double-checks the ledger by summarizing account balances, and making sure the debits match the credits. The general ledger is the primary accounting record of a company. It organizes all transactions by account, providing a record of each transaction that affects each account.

To retain the accounting equation’s net-zero discrepancy, one asset account must enhance while another reduces by the same quantity. The recent balance for the cash account, after the net change from the transaction, will then be reported daily contract rates reflected in the balance category. It is no secret that the realm of accounting is operated by debits and credits. Before we hop into the golden doctrines of accounting, you require to brush up on all things credit and debit.

Recommended Posts

Unrestricted Net Assets Definition and Explanation

6 de julho de 2023

What Is Depreciation? Definition, Types, How to Calculate

11 de maio de 2023

What is Trial Balance? Definition & Importance Ohio University

27 de março de 2023